Tax

International tax services

Whether you are establishing a business in the UK, relocating staff abroad or to the UK, or returning home from overseas, we can help.

With advice on taxation of overseas, remuneration, tax residency status and compliance matters, let our experts guide you through the complexities.

How can we help you?

Each country has its own tax rules, which interact in different ways with UK law. Through our membership of HLB International (a global network of independent professional accounting firms and business advisers) we can introduce you to professional tax and business advisers anywhere in the world.

Their expertise will ensure compliance wherever you operate, whilst we use our complementary skills to develop a tax structure that minimises your global tax liability. Naturally, our service also includes all aspects of compliance arising from your international activities.

International Corporate Tax

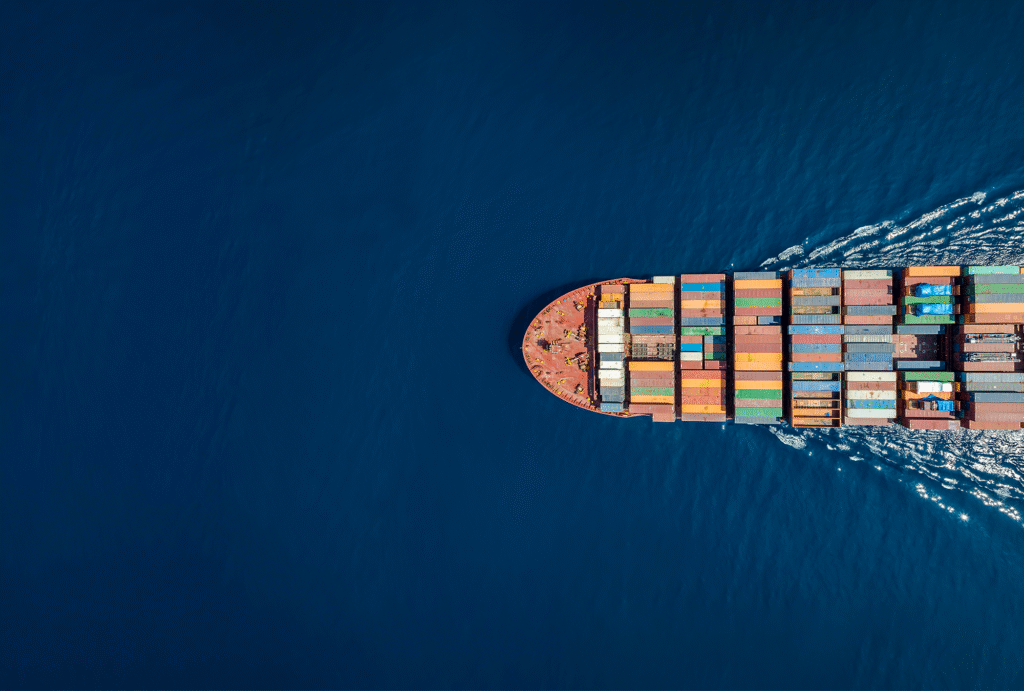

Doing business across borders brings opportunities to access new markets, supply chains or skills but can exponentially increase the risk of paying too much tax.

Companies with overseas investors, foreign subsidiaries, foreign operations or who are making cross- border payments will have to consider international tax issues. As well as being subject to UK tax rules, other countries may seek to tax profits or payments. This can result in double taxation. Our experts help businesses to navigate this complexity and maximise opportunities with a practical and commercially focused approach.

Whether you are an established multinational group, expanding abroad or entering the UK market, we can advise on:

- Transfer pricing

- Branch taxation

- Profit repatriation

- Funding issues

- Corporate residence

- Withholding taxes

- Treaty claims

- Controlled foreign companies

- International support

Employing staff and working overseas

When an organisation operates overseas, it needs to be able to relocate key staff to ensure optimum operational performance. These individuals will need to perform to the best of their ability, and one of the considerations in this will be remuneration. For staff leaving the UK, there will also be home and overseas tax issues to consider as they depart, and further complications when they return.

At Hazlewoods we can advise across all relevant areas:

- Tax implications on leaving the UK and returning

- Taxation of overseas remuneration

- Residence and domicile status (including advice on Statutory Residence Test and non-dom status)

- Remittance basis

- UK tax returns

- Compliance matters when leaving the UK and returning

- Tax-efficient remuneration packages

Are your employees living abroad?

Or looking to relocate overseas and work remotely? Watch the video to hear one of our Tax Directors, Glenn Collingbourne, talk through the tax considerations you need to be aware of to ensure compliance.